Real Estate Market Update - Seattle and Bellevue - June 2021

Happy July! We are well into the busy summer season, and it is my pleasure to provide to you as much relevant real estate information as possible as your real estate professional. This article contains numerous links to more information, videos with quick infographic statistic updates, and updates from local lenders from the mortgage & financing prospective. Contact me anytime to discuss this info and what it means to you. Let me know if you would like specific information for your neighborhood and share with me any information you come across to help me make this info the best it can be.

According to the Northwest Multiple Listing Service (NWMLS):

“ KIRKLAND, Washington (July 7, 2021) - Homebuyers may find some good news in the latest report from Northwest Multiple Listing Service (NWMLS). The number of active listings at the end of June, 6,358, reached the highest level since November when buyers could choose from 6,505 properties. The volume of new listings added last month was the highest number in 17 months (13,111 last month versus 14,689 at the end of November 2019). "Homebuyers will be happy to hear that between May and June the number of listings in King, Pierce, and Snohomish counties rose, giving them more homes to choose from and possibly easing the pressure just a little," remarked Matthew Gardner, chief economist at Windermere Real Estate...." To read the complete NWMLS June Press Release click here

Even in this challenging buyers market, I was able to help my clients find homes they love. Chuka and Paulina were searching all around the Eastside; Bellevue, Sammamish, Bothell, Kirkland, Redmond, and actually ended up finding the gorgeous home above in Renton. Katie and Nick were searching in and around Gig Harbor, and were able to find this lovely home right on the lake!

Lender updates from Tina, Eric, & Mark

If you want to know what is happening with the money-side of things in real estate, ask a mortgage lender. Below is info from Tina, Eric & Mark. I hope you find this info helpful. These lenders are available for you and can provide information to you regarding your plans to purchase or refinance a home. Let me know if you talk with them and how I can assist you as your Realtor. Thanks! Jen 206-550-1676

Mortgage Update - Tina gives a complete economic overview and how that relates to real estate. Demand is high, supply is low, the market is hot. (See Tina’s 4 minute video above)

Tina Mitchell with Highlands Residential Mortgage is a fabulous lender. She has been in the mortgage industry for over 2 decades and has been recognized in the top 1% Nationwide. She is a numbers gal and can talk with you about possible loan options. I also really like her communication style. You can schedule a time with Tina now (for a video zoom conference call) using this link. She is available by cellular phone and even works nights & weekends! Tina promptly follows up your no obligation consultation with informative emails showing your different loan options, estimations of costs, and other important info in writing and throughout the process has the best communications of any lender I have ever seen. The first step is to schedule a meeting to review loan options, cash needed and payment breakdown. There is no cost or commitment to move forward, it’s just education. Call Tina now or if it’s more convenient you can use the following online calendar to Schedule a Consultation at https://calendly.com/tinamitchell/. Tina Mitchell, Highlands Residential Mortgage • Loan Originator, NMLS 145420 • Cellular: (425) 647-0205 • “Live Your Dream Now!” See Tina’s website at: www.TinaMitchellTeam.com

These thorough market updates from lender, Eric Aasness, Branch Sales Manager, Homebridge Financial are full of great charts and economic information. At the end of each article, Eric has included the links to more than 10 additional articles related to home loans and the real estate market.

May 28, 2021 - Highest Inflation in Decades, But Housing Has a Bigger Problem

June 4, 2021 - What This Week's Jobs Report Means For Rates

June 11, 2021 - One of The Biggest Paradoxes You'll Ever See For Mortgage Rates

June 18, 2021 - Making Sense of This Week's Fed Drama

June 25, 2021 - Mortgage Market's Most Powerful Person Just Got Fired. What Are The Implications?

Here are some additional market updates provided by Mark Williams at Fairway Independent Mortgage Corporation:

May 21, 2021 - Home Sales Fall

June 4, 2021 - Solid Job Gains

June 11, 2021 - Inflation Picks Up

June 18, 2021 - Fed Surprises Investors

June 25, 2021 - Inflation Climbs

Compared to last week new listings are way up (+528)! With the Fourth of July falling on a Sunday many people took their vacations the week before or after. The pending, sold, and other categories had minimal change from the prior week. If you are looking for info specific to your neighborhood, please call, text, or DM me for info! Thanks! Jen 206-550-1676👩🏼💼👍

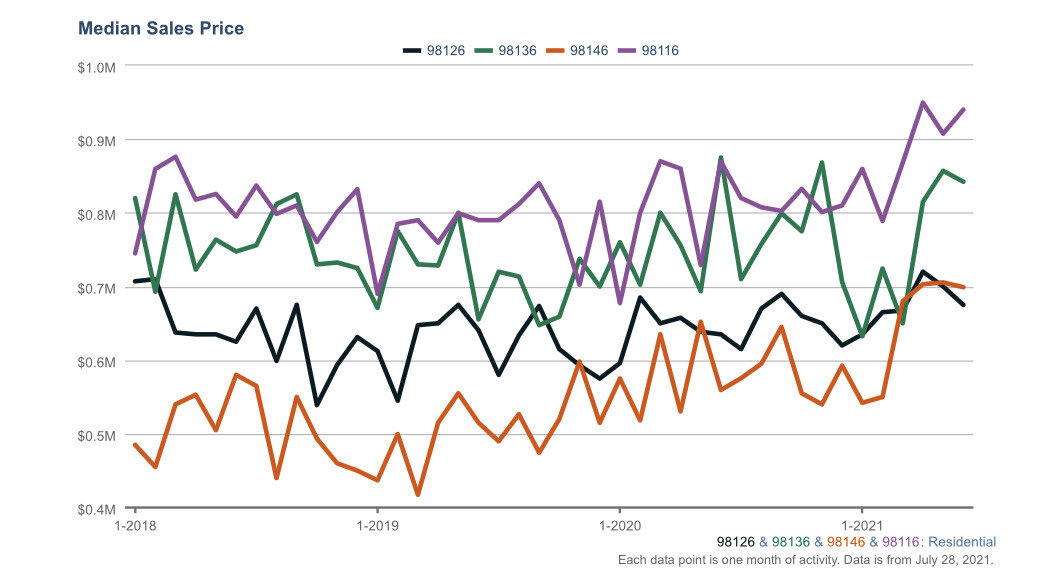

The graphs below contains information specific to the West Seattle area. Also, all of the images below are links to the interactive versions of the graphs! Just click on a graph and move your cursor along the line to see specific stats for every month throughout the years 2018-2021. Contact me if you have any questions or if you want any of these graphs made for your specific area!

Inventory throughout this year has remained low and is still low. This means that currently there are more buyers than sellers, making this an amazing time to sell!

As you can see the days a listing spends on market tends to spike at the beginning of each year. This is mostly due to the fact that January and February are follow up months to an extremely busy Holiday season starting in November.

If you have any thoughts or questions about this information or would like to talk, please call or text me at 206-550-1676. If you find great articles that you would like to share with me, please email those to me at jen@jensrealty.com. I am always working hard to be your source for real estate information!

Check back for more updates throughout the year. Let’s talk about the market now in your neighborhood, your real estate goals, and whether or not this is a good time for you to list and sell your home. Call, text, or email anytime. I’m always here to help! Thank you,

Jennifer Suemnicht - Jen's Realty - RE/MAX Metro Realty, Inc.

www.JensRealty.com / 206-550-1676 / jen@jensrealty.com

With inventory and interest rates at historic lows it’s a great time to sell. And if you are looking to buy, I can help you with a smooth transition into a home you love! Click the photo to contact me, or you can call/text me at 206-550-1676! - Jen:)

Here are some links to more articles & videos.

These helpful links are provided by Eric Aasness. If you find great articles that you would like to share with me, please email those to me at jen@jensrealty.com. I am always working hard to be your source for real estate information! Thanks, Jen

Jennifer Suemnicht - Jen's Realty - RE/MAX Metro Realty, Inc.

Realtor / Broker

206-550-1676 / www.JensRealty.com

Housing Market Update: Is Relief From The Red-Hot Market On Its Way? Redfin

Jobs report shows improvement, but not strong enough to get Fed talking about tapering CNBC

Comments on May Employment Report Calculated Risk Blog

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased Calculated Risk Blog

More than 14% of renters are still behind as national eviction ban comes to an end CNBC

Fannie Mae Extends Protections for Renters Affected by COVID-19 Fannie Mae

Census Report Itemizes New Home Features Mortgage News Daily

Weekly jobless claims total 385,000, vs 393,000 estimate CNBC

Private payrolls rose by 978,000 in May, vs 680,000 estimate: ADP CNBC

Is Commute Time Becoming a Housing Factor? Mortgage News Daily

3.7 million Americans set to lose unemployment benefits early as 25 states exit federal programs CNBC

Fed's Harker says it's time to 'think about thinking about' tapering Reuters

High-End Home Sales Surge Nearly Twice as Fast as Sales of Mid-Priced Homes Redfin

Construction Spending Increased Slightly in April, Led by Residential Sector Mortgage News Daily

April's Home Prices Grew by 13% and Broke More Records Mortgage News Daily

Update: Framing Lumber Prices Down from Recent Peak, Up Sharply Year-over-year Calculated Risk Blog

Wall Street muted as eyes turn to next week's Fed meeting Reuters

Homeowners get $2 trillion richer in red-hot housing market CNBC

10-year Treasury yield falls below 1.45% as bond market shrugs off inflation concerns CNBC

Mortgage Lenders' Profitability Outlook Tightens Further Following 2020 Refi Boom Fannie Mae

Consumer prices jump 5% in May, fastest pace since the summer of 2008 CNBC

U.S. senators pursue infrastructure plan without tax hikes Reuters

Housing Insights: Housing Poised to Become Strong Driver of Inflation Fannie Mae

Housing and Demographics: The Next Big Shift Calculated Risk Blog

Contrarian Take on Fed's Current Policy Stance Around The Web

Early State Delinquencies Drop Below Pre-COVID Levels Mortgage News Daily

Job openings set new record of 9.3 million amid economic reopening CNBC

Northwest Real Estate in May: Sales up 57% YoY, Inventory down 47% YoY Calculated Risk Blog

Lack of Homes for Sale Could Eventually Curb Affordability Constraints Mortgage News Daily

Homebuying Sentiment Hits Another Low, Even as Incomes Rise Mortgage News Daily

Technology Continues to Reduce Closing Times Mortgage News Daily

Fed tiptoes into taper campaign to avoid market upheaval CNBC

Investors juggle Fed forecast and post-pandemic recovery as Wall Street dips Reuters

Invitation Homes CEO says he's not worried about a housing bubble despite price spikes. Here's why CNBC

The Fed will continue to dominate the market in the week ahead after sell-off CNBC

Fed's Jim Bullard sees first interest rate hike coming as soon as 2022 CNBC

Lawler: Early Read on Existing Home Sales in May Calculated Risk Blog

Inflation Holds Key to Fannie Mae's New Forecast Mortgage News Daily

No, Mortgage Rates Aren't Lower Today! Mortgage News Daily

Fed is about to shift gears, but this time it may be different Reuters

Over Half of Homes Sold Above List Price in May for the First Time On Record Redfin

U.S. weekly jobless claims total 412,000, vs 360,000 estimate CNBC

Rates Jump After Fed Announcement Mortgage News Daily

U.S. fed funds futures raise rate hike chances in early 2023 after Fed statement Reuters

Fed leaves interest rates unchanged, increases inflation forecast CNBC

The typical home price is up a 'record' 13.2% compared to last year, according to Zillow CNBC

Instant Reaction: Housing Starts, June 16, 2021 Around The Web

May Housing Starts Post Modest Recovery from April's Slump Mortgage News Daily

Rising Lumber and Material Costs Put a Dent in Builder Confidence Mortgage News Daily

How Second Home Sales are Driving Price Gains Mortgage News Daily

Mortgage Application Volume Rises After Three Straight Losses Mortgage News Daily

Housing-Market Competition Has Eased Slightly, But 7 in 10 Buyers Still Face Bidding Wars Redfin

With eviction ban expiring in 14 days, many states have given out under 5% of rental assistance CNBC

Industrial Production Increased 0.8 Percent in May Calculated Risk Blog

Retail Sales Decreased 1.3% in May Calculated Risk Blog

Producer prices climb 6.6% in May on annual basis, largest 12-month increase on record CNBC

Mortgage Equity Withdrawal in Q1 2021 Calculated Risk Blog

Housing Inventory June 14th Update: Inventory Increased Week-over-week Calculated Risk Blog

What's at stake for markets as U.S. debt ceiling looms Reuters

Fed's Kaplan sees 'upside risk' to inflation forecast Reuters

NY Fed's Williams says U.S. economy still far from maximum employment, not the time to lift rates Reuters

Fed's Bullard warns may be more inflation risk to come Reuters

New Home Sales Hit 12 Month Low Despite Higher Inventory Mortgage News Daily

Calabria is Out at FHFA Mortgage News Daily

NAR Responds to SCOTUS Decision on FHFA Leadership Structure Around The Web

AIA: "Architecture billings continue historic rebound" in May Calculated Risk Blog

A few Comments on May New Home Sales Calculated Risk Blog

May Marked Fourth Month of Decline for Existing Home Sales Mortgage News Daily

Lumber Prices are Plummeting, but Still Historically Expensive Mortgage News Daily

Comments on May Existing Home Sales Calculated Risk Blog

Wall Street is Loving Single Family Rentals Mortgage News Daily

Seven High Frequency Indicators for the Economy Calculated Risk Blog