Real Estate Market Update - Seattle and Bellevue - September 2021

Hello all! The beautiful fall season is here, and it is my pleasure to provide to you as much relevant real estate information as possible as your real estate professional. This article contains numerous links to more information, videos with quick infographic statistic updates, and updates from local lenders from the mortgage & financing prospective. Contact me anytime to discuss this info and what it means to you. Let me know if you would like specific information for your neighborhood and share with me any information you come across to help me make this info the best it can be.

According to the Northwest Multiple Listing Service (NWMLS):

“ KIRKLAND, Washington (October 6, 2021) - September's housing market remained "very active" to "frenzied" around Washington state with brokers reporting year-over-year (YOY) gains in new listings, closed sales, and prices. Brokers with Northwest Multiple Listing Service also detected growing stability in the condominium market. "Historically low interest rates continue to drive the real estate market," remarked Dean Rebhuhn, owner at Village Homes and Properties. He also cited pent-up buyer demand, job and lifestyle changes, and inventory shortages as factors contributing to a "very active market." A new report from Northwest MLS shows brokers added slightly more new listings last month (11,373) than a year ago (11,210). That volume, which includes single-family homes and condominiums, nearly matched the total for August (11,437), and barely outgained the number of pending sales (11,318) for the 26 counties in the report....." To read the complete NWMLS September Press Release click here!

September was a busy month! Here are just a couple of the homes I had pleasure to work on. These 2 were especially interesting because both of these homes were actually owned by the same couple! A friend I used to work with recommended me to them and they were delightful. Both of these homes were rentals and they decided to hire a contractor to do a little work to help freshen them up. After the contractors were done we staged the homes both psychically and virtually! This combined with the professional photography, open houses, and high-quality marketing made the homes not only quick sellers with multiple offers, but both set new highest sale price records in their communities!

If you want to stay up to date on what else I was doing in September or any past months activities, go check out my Instagram and Facebook @jensrealty!🤩👍

For more personal and in depth updates, sign up for my newsletter here: Contact me!

Lender updates from Tina, Eric, & Mark

If you want to know what is happening with the money-side of things in real estate, ask a mortgage lender. Below is info from Tina, Eric & Mark. I hope you find this info helpful. These lenders are available for you and can provide information to you regarding your plans to purchase or refinance a home. Let me know if you talk with them and how I can assist you as your Realtor. Thanks! Jen 206-550-1676

Mortgage Update - Tina gives a complete economic overview and how that relates to real estate. Demand is high, supply is low, the market is hot. (See Tina’s 4 minute video above)

Tina Mitchell with Highlands Residential Mortgage is a fabulous lender. She has been in the mortgage industry for over 2 decades and has been recognized in the top 1% Nationwide. She is a numbers gal and can talk with you about possible loan options. I also really like her communication style. You can schedule a time with Tina now (for a video zoom conference call) using this link. She is available by cellular phone and even works nights & weekends! Tina promptly follows up your no obligation consultation with informative emails showing your different loan options, estimations of costs, and other important info in writing and throughout the process has the best communications of any lender I have ever seen. The first step is to schedule a meeting to review loan options, cash needed and payment breakdown. There is no cost or commitment to move forward, it’s just education. Call Tina now or if it’s more convenient you can use the following online calendar to Schedule a Consultation at https://calendly.com/tinamitchell/. Tina Mitchell, Highlands Residential Mortgage • Loan Originator, NMLS 145420 • Cellular: (425) 647-0205 • “Live Your Dream Now!” See Tina’s website at: www.TinaMitchellTeam.com

These thorough market updates from lender, Eric Aasness, Branch Sales Manager, Homebridge Financial are full of great charts and economic information. At the end of each article, Eric has included the links to more than 10 additional articles related to home loans and the real estate market.

September 3, 2021 - Soaring Prices, Slumping Sales, And An Unexpected Reaction to The Jobs Report

September 10, 2021 - Rate Reckoning Draws Closer

September 17, 2021 - Rates at 2-Month Highs; Big Changes For Investor/2nd Home Loans

September 24, 2021 - Who's Lying About The Spike in Mortgage Rates?

Here are some additional market updates provided by Mark Williams at Fairway Independent Mortgage Corporation:

September 3, 2021 - Job Gains Fall Short

September 10, 2021 - Job Openings Surge

September 17, 2021 - Retail Sales Jump

September 24, 2021 - Mortgage Rates Rise

Compared to the prior week there were four significant changes. New listings were down 182 from the prior week. Pendings, Price Reductions, and Solds increased 256, 108, and 217 respectively. I would have expected new listings to have increased by now… It will be interesting to see what happens next week and we may need to take a deeper dive into the statistics!🤩👍

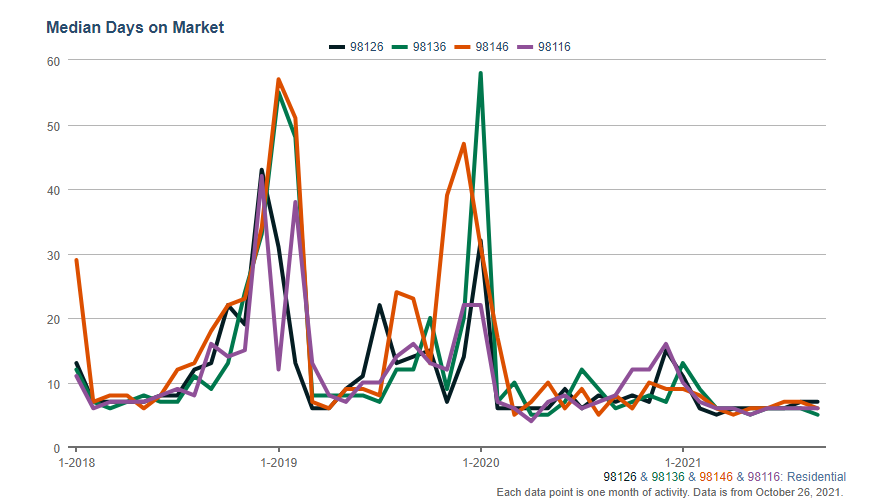

The graphs below contains information specific to the West Seattle area. Also, all of the images below are links to the interactive versions of the graphs! Just click on a graph and move your cursor along the line to see specific stats for every month throughout the years 2018-2021. Contact me if you have any questions or if you want any of these graphs made for your specific area!

Inventory throughout this year has remained low and is still low. This means that currently there are more buyers than sellers, making this an amazing time to sell!

As you can see the days a listing spends on market tends to spike at the beginning of each year. This is mostly due to the fact that January and February are follow up months to an extremely busy Holiday season starting in November.

If you have any thoughts or questions about this information or would like to talk, please call or text me at 206-550-1676. If you find great articles that you would like to share with me, please email those to me at jen@jensrealty.com. I am always working hard to be your source for real estate information!

Check back for more updates throughout the year. Let’s talk about the market now in your neighborhood, your real estate goals, and whether or not this is a good time for you to list and sell your home. Call, text, or email anytime. I’m always here to help! Thank you,

Jennifer Suemnicht - Jen's Realty - RE/MAX Metro Realty, Inc.

www.JensRealty.com / 206-550-1676 / jen@jensrealty.com

With inventory and interest rates at historic lows it’s a great time to sell. And if you are looking to buy, I can help you with a smooth transition into a home you love! Click the photo to contact me, or you can call/text me at 206-550-1676! - Jen:)

Here are some links to more articles & videos.

These helpful links are provided by Eric Aasness. If you find great articles that you would like to share with me, please email those to me at jen@jensrealty.com. I am always working hard to be your source for real estate information! Thanks, Jen

Jennifer Suemnicht - Jen's Realty - RE/MAX Metro Realty, Inc.

Realtor / Broker

206-550-1676 / www.JensRealty.com

Comments on August Employment Report Calculated Risk Blog

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased Calculated Risk Blog

August nonfarm payrolls increase 235,000 vs. 720,000 estimate CNBC

Construction Spending: Residential is Only Game in Town Mortgage News Daily

HUD Unveils Multi-Agency Affordable Housing Plans Mortgage News Daily

Here's why experts believe the U.S. is in a housing boom and not a bubble CNBC

Affordable Housing Concerns and Food Insecurity Linked, NAR Report Finds NAR

European Central Bank to announce tapering in December, analysts say CNBC

Housing Market Update: 9% Increase in Pending Home Sales is Slowest Growth Since June 2020 Redfin

Zillow Case-Shiller House Price Forecast: 20%+ Year-over-year in July Calculated Risk Blog

Decline in Refis Pulls Mortgage Application Volume Lower Mortgage News Daily

Freddie Mac's Purchase Volumes Eroded in July Mortgage News Daily

Private payrolls increase by just 374,000 in August, far short of the 600,000 estimate, ADP says CNBC

U.S. consumer confidence falls to 6-month low; house prices post record gains Reuters

Investor Share of Home Purchases in Decline Mortgage News Daily

Home Prices Continue Runaway Gains, More Double-Digit Growth in June Mortgage News Daily

Reis: Apartment Vacancy Rate unchanged in Q2 at 5.3% Calculated Risk Blog

GSEs Outline Available Hurricane Ida Relief Mortgage News Daily

Inventories Continue to Constrain Home Purchase Activity Mortgage News Daily

Housing affordability to worsen near-term, even as price rises cool off: Reuters poll Reuters

Seven High Frequency Indicators for the Economy Calculated Risk Blog

Lenders Continue to Expect Falling Profits, Refinancing Demand Mortgage News Daily

Foreclosure Activity Rises in First Post-Moratorium Month Mortgage News Daily

Huge Decline in Forbearances, Down 67 Percent From Peak Mortgage News Daily

Strained supply chains keep U.S. producer prices hot Reuters

Hiring Slows Despite Record Number of Job Openings, While Upward Price Pressures Continue Fannie Mae

Tappable Equity Surge; More Refi Programs; Rates Fall MND's Daily Newsletter

Credit Loosens as New Refi Programs Come on Line Mortgage News Daily

Equity Explosion Bodes Well for Lenders Mortgage News Daily

Fannie/Freddie Will Develop New Plans for Equitable Financing Mortgage News Daily

European bonds rally as ECB keeps stimulus cut to a minimum Reuters

U.S. job openings vault to record high as employers scramble for workers Reuters

Home Buying Sentiment Improves Slightly Mortgage News Daily

CoreLogic: Home Price Gains Expected to Slow to 2.7% by Next Year Mortgage News Daily

Update: Framing Lumber Prices Up Year-over-year Calculated Risk Blog

48% of renters worry they won't ever be able to buy a home, survey finds CNBC

Lawler: Early Read on Existing Home Sales in August Calculated Risk Blog

Consumer sentiment index comes in slightly lower than forecasts CNBC

November? December? Fed's 'taper' timeline tied to volatile jobs data Reuters

Refis and Purchasing Split Originations in July Mortgage News Daily

Home Sales Fell 6% in August, the First Annual Decline in 15 Months Redfin

Fed's Powell orders sweeping ethics review after officials' trading prompts outcry Reuters

Foreclosure Rate Lowest in Over Two Decades Mortgage News Daily

FHFA Suspends Second Home, Investment Loan Limits Mortgage News Daily

Purchase Applications Spring Back to April Level Mortgage News Daily

U.S. Treasury yields dip following cooler-than-expected inflation reading CNBC

America is short more than 5 million homes, and builders can't make up the difference CNBC

FHFA and Treasury Suspending Certain Portions of the 2021 Preferred Stock Purchase Agreements FHFA

Evergrande investors in limbo after payment deadline passes Reuters

Less Intense Multi-bidding and Fewer First-time Buyers in August 2021 NAR

U.S. Senate showdown vote on debt limit could come next week Reuters

Inventories Pushing Buyers Toward New Homes Mortgage News Daily

Mortgage Applications Rise, Reflecting Improved Inventories Mortgage News Daily

Demand for Second Homes Fell 19% Year Over Year in August Redfin

Construction Numbers Pushed Higher by Multifamily Surge Mortgage News Daily

Freddie Mac Confirms Heightened Appraisal Gaps in Minority Areas Mortgage News Daily

Builder Sentiment Moves Slightly Higher, but Many Still See Hurdles Ahead Mortgage News Daily

NAHB: Builder Confidence Increased to 76 in September Calculated Risk Blog